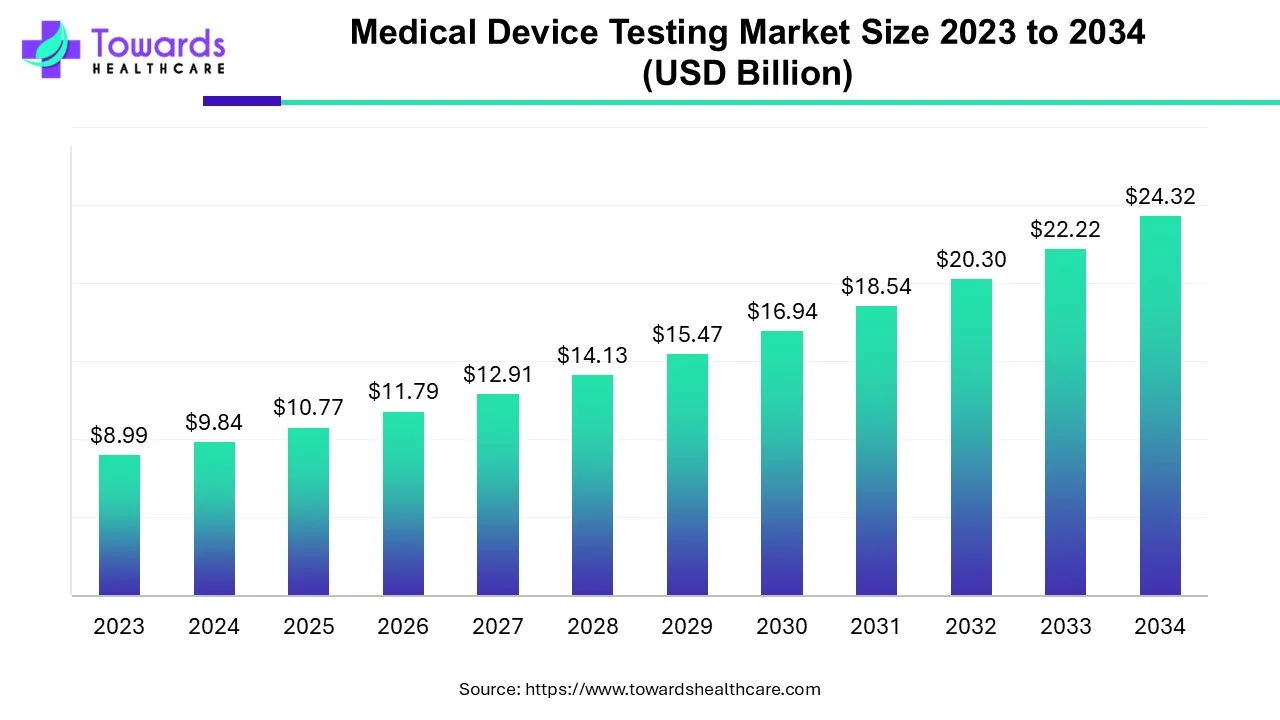

Medical Device Testing Market Expected to Surpass USD 24.32 Billion by 2034

The global medical device testing market size was valued at USD 9.84 billion in 2024 and is predicted to hit around USD 24.32 billion by 2034, rising at a 9.47% CAGR, a study published by Towards Healthcare a sister firm of Precedence Research.

Ottawa, Dec. 08, 2025 (GLOBE NEWSWIRE) -- The global medical device testing market size is calculated at USD 10.77 billion in 2025 and is expected to reach around USD 24.32 billion by 2034, growing at a CAGR of 9.47% for the forecasted period. A rise in the need for trustworthy and high-quality medical devices is propelling the expansion of the global market.

The Complete Study is Now Available for Immediate Access | Download the Sample Pages of this Report @ https://www.towardshealthcare.com/download-sample/5457

Key Takeaways

- Asia-Pacific led the global medical device testing market in 2024.

- North America is expected to witness rapid expansion during 2025-2034.

- By service, the biocompatibility tests segment was dominant in the market in 2024.

- By service, the chemistry tests segment is expected to register significant growth in the coming years.

- By phase, the clinical segment held the dominating share of the global medical device testing market in 2024.

- By phase, the preclinical segment is expected to grow at a notable CAGR during 2025-2034.

Market Overview & Potential

A process in which the evaluation of the safety, efficiency, and performance of medical devices is conducted, termed medical device testing. Across the globe, the global medical device testing market is experiencing growing regulatory strictness, technological breakthroughs, and a rising healthcare sector. In 2025, it comprises major developments in in-vitro diagnostics (IVD), and the execution of the EU's Medical Device Regulation (MDR) around the market. Usually, it encompasses the evaluation, functionality, durability, sterility, biocompatibility, electrical safety, and usability of the medical device.

What are the Key Growth Drivers Involved in The Expansion of The Market?

In 2025, several growth factors are impacting the overall development of the global medical device testing market. The growing geriatric population associated with chronic concerns is driving demand for diverse medical devices involved in diabetes management, mobility assistance, and remote patient monitoring. Along with this, an emerging strict regulatory landscape, such as the FDA and the EU’s MDR, is offering strong testing guidelines for safety and efficacy. Majorly, different developing medical device producers, particularly startups, are highly outsourcing testing to specialized firms, resulting in market growth.

What are the Key Drifts Involved in the Market?

- In August 2025, BDC Laboratories, a leading player in cardiovascular device testing solutions, entered into a strategic partnership with the newly established Dilawri Cardiovascular Institute (DCI) to enhance focus on the development and clinical validation of cardiovascular medical devices.

- In October 2024, NAMSA, a leader in MedTech Contract Research Organization (CRO) offering end-to-end market access services, and TERUMO, a global player in medical technology, partnered to expand the regulatory approval and commercialization of Terumo’s product portfolio.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

What is the Emerging Challenge in the Market?

The need for significant investment in specialized equipment, skilled personnel, and ongoing compliance efforts is creating a major hindrance in the global medical device testing market. Alongside, the widespread requirement for specialized knowledge and skills in areas like biocompatibility, sterilization, and electrical safety is evolving into a barrier to the development of the market.

Regional Analysis

Why Did Asia Pacific Dominate the Market in 2024?

Across the global medical device testing market, the Asia Pacific was dominant in 2024. China, India, and Japan are experiencing a vital expansion due to increasing economies and growing disposable incomes. This ultimately results in a rise in investment in the healthcare system and medical devices, propelling the adoption of various testing services. Additionally, faster advances in different technologies, such as miniaturization, digitalization, and the development of new materials, are enhancing the need for specialized testing services.

For instance,

- In March 2025, UL Solutions Inc., a major player in applied safety science, announced its expansion of Songshan Lake IoT Laboratory in Dongguan, China, to support manufacturers in navigating the complexities of connected product and wireless device testing and market access.

What Made North America Significantly Grow in the Market in 2024?

During 2025-2034, North America is predicted to expand at a rapid CAGR in the global medical device testing market. Merging high R&D investment by many medical device companies, like the adoption of technologies like AI and automation, in this region, is fueling overall market development. Also, North America is focusing on patient safety and regulatory compliance, especially in the US, which requires rigorous testing throughout the product lifecycle.

For this market,

- In January 2025, Argon Medical Devices enrolled the first patient in a US-based study exploring a newer catheter-based device for managing blood clots in the lungs.

- In June 2025, Ash, a leading at-home health testing platform, and Impilo, a leader in offering at-home healthcare, partnered to deliver feasible at-home health monitoring and testing nationwide.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Segmental Insights

By service analysis

Which Service Led the Medical Device Testing Market in 2024?

The biocompatibility tests segment held the largest revenue share of the market in 2024. Around the globe, numerous medical device manufacturers are preferring biocompatibility testing to achieve market acceptance and develop a robust reputation for quality and safety. Along with this, these tests are important for reducing the risk of adverse reactions, infections, and other difficulties linked with medical devices. This leads to ensuring patient safety and improving device efficacy.

Whereas the chemistry tests segment is predicted to grow rapidly during 2025-2034. Several advantages of this segment are the assessment of the possible toxicity of medical devices and confirming that they will not react negatively with the body. Additionally, the chemistry tests are widely employed in broader devices, from simple disposables to complex implants, to ensure their safety and regulatory compliance. Primarily, they comprise the identification of chemical compounds of a medical device and examination of probable risks linked with their presence, which further assist in biocompatibility assessment.

By phase analysis

How did the Clinical Segment Hold a Major Share of the Market in 2024?

The clinical segment dominated the global medical device testing market in 2024. Usually, different phases of clinical trials offer significant real-world evidence that assists healthcare professionals in making informed decisions about device usage and expands the continuous optimization of medical devices. A surge in 3D printing and AI in medical device manufacturing is boosting the need for clinical trials to study the performance and safety of these new technologies. Also, the segment is driven by the accelerating need for advanced medical devices, a focus on patient safety and efficacy, and a rise in regulatory scrutiny.

The preclinical segment is predicted to witness significant expansion in the studied years. Ongoing developments in biocompatibility testing, microbiology testing, and package validation are widely impacting the development of the preclinical phase of the market. Furthermore, various medical device industries, especially small-scale ones, have a shortage of resources or well-trained personnel to execute complete preclinical testing in-house. This further propels the demand for specialized preclinical testing service providers. Whereas, currently growing diverse chronic diseases are fueling demand for enhanced patient safety, which ultimately relies on the development of the preclinical phase.

Become a valued research partner with us - https://www.towardshealthcare.com/schedule-meeting

Recent Developments

- In July 2025, Siemens Healthineers launched the CN-3000 and CN-6000 Hemostasis Systems for coagulation testing in Canada.

- In May 2025, Roche unveiled the Elecsys PRO-C3 test for the evaluation of the liver fibrosis severity in individuals with signs of metabolic dysfunction–associated steatotic liver disease (MASLD).

- In March 2025, Nelson Labs launched a groundbreaking rapid sterility testing to notably expedite product sterility results.

- In October 2024, UPM Biomedicals, the forerunner in producing high quality nanofibrillar cellulose for medical and life science applications, introduced FibGel, a natural injectable hydrogel for permanent implantable medical devices.

Browse More Insights of Towards Healthcare:

The medical device CMO and CDMO market is on an upward trajectory, poised to generate substantial revenue growth, potentially climbing into the hundreds of millions over the forecast years from 2025 to 2034.

The global medical device CRO market size is calculated at USD 8.49 billion in 2024, grew to USD 9.25 billion in 2025, and is projected to reach around USD 19.9 billion by 2034. The market is expanding at a CAGR of 8.98% between 2025 and 2034.

The global medical device outsourcing market size is calculated at US$ 180.59 billion in 2025, grew to US$ 203.43 billion in 2026, and is projected to reach around US$ 594.3 billion by 2035. The market is expanding at a CAGR of 12.65% between 2026 and 2035.

The medical device gaskets & seals market was estimated at US$ 0.92 billion in 2023 and is projected to grow to US$ 1.57 billion by 2034, rising at a compound annual growth rate (CAGR) of 5% from 2024 to 2034.

The global medical device contract manufacturing market size is calculated at USD 78.61 billion in 2024, grew to USD 87.14 billion in 2025, and is projected to reach around USD 220.57 billion by 2034. The market is expanding at a CAGR of 10.86% between 2025 and 2034.

The 3D Printed medical devices market is anticipated to grow from USD 5.59 billion in 2025 to USD 24.69 billion by 2034, with a compound annual growth rate (CAGR) of 17.94% during the forecast period from 2025 to 2034.

The global Class C & Class D medical devices market size recorded US$ 55.13 billion in 2024, set to grow to US$ 69.52 billion in 2025 and projected to hit nearly US$ 559.55 billion by 2034, with a CAGR of 26.12% throughout the forecast timeline.

The global implantable medical devices market size is calculated at USD 103.14 billion in 2025, grew to USD 109.47 billion in 2026, and is projected to reach around USD 187.16 billion by 2035. The market is expanding at a CAGR of 6.14% between 2026 and 2035.

The global wearable medical devices market size is calculated at USD 42.78 billion in 2024, grew to USD 53.68 billion in 2025, and is projected to reach around USD 408.61 billion by 2034. The market is expanding at a CAGR of 25.57% between 2025 and 2034.

The global smart medical devices market size is calculated at US$ 26.62 billion in 2025, grew to US$ 28.55 billion in 2026, and is projected to reach around US$ 53.65 billion by 2035. The market is expanding at a CAGR of 7.26% between 2026 and 2035.

Who are the Medical Device Testing Market Key Players?

- SGS SA

- Laboratory Corporation of America Holdings

- Nelson Laboratories, LLC

- TÜV SÜD

- Charles River Laboratories

- Element Minnetonka

- North America Science Associates Inc. (NAMSA)

- Eurofins Scientific

- Pace Analytical Services LLC

- Intertek Group Plc

- WuXi AppTec

Segments Covered in The Report

By Service

- Biocompatibility Tests

- Cardiovascular Device's Biocompatibility Tests

- Orthopedic Device's Biocompatibility Tests

- Dental Implant Devices' Biocompatibility Tests

- Dermal Filler's Biocompatibility Tests

- General Surgery Implantation Devices Biocompatibility Tests

- Neurosurgical Implantation Devices Biocompatibility Tests

- Ophthalmic Implantation Device's Biocompatibility Tests

- Others

- Chemistry Test

- Chemical characterization (E&L)

- Analytical method development and validation

- Toxicological Risk Assessment and consulting

- Microbiology & Sterility Test

- Bioburden Determination

- Pyrogen & Endotoxin Testing

- Sterility Test & Validation

- Antimicrobial Testing

- Others

- Package Validation

By Phase

- Preclinical

- Large animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Small animal research

- Biocompatibility Tests

- Chemistry Test

- Microbiology & Sterility Test

- Large animal research

- Clinical

By Region

- North America

- U.S.

- Canada

- Asia Pacific

- China

- Japan

- India

- South Korea

- Thailand

- Europe

- Germany

- UK

- France

- Italy

- Spain

- Sweden

- Denmark

- Norway

- Latin America

- Brazil

- Mexico

- Argentina

- Middle East and Africa (MEA)

- South Africa

- UAE

- Saudi Arabia

- Kuwait

Immediate Delivery Available | Buy This Premium Research @ https://www.towardshealthcare.com/checkout/5457

Access our exclusive, data-rich dashboard dedicated to the healthcare market - built specifically for decision-makers, strategists, and industry leaders. The dashboard features comprehensive statistical data, segment-wise market breakdowns, regional performance shares, detailed company profiles, annual updates, and much more. From market sizing to competitive intelligence, this powerful tool is one-stop solution to your gateway.

Access the Dashboard: https://www.towardshealthcare.com/access-dashboard

About Us

Towards Healthcare is a leading global provider of technological solutions, clinical research services, and advanced analytics, with a strong emphasis on life science research. Dedicated to advancing innovation in the life sciences sector, we build strategic partnerships that generate actionable insights and transformative breakthroughs. As a global strategy consulting firm, we empower life science leaders to gain a competitive edge, drive research excellence, and accelerate sustainable growth.

You can place an order or ask any questions, please feel free to contact us at sales@towardshealthcare.com

Europe Region: +44 778 256 0738

North America Region: +1 8044 4193 44

APAC Region: +91 9356 9282 04

Web: https://www.towardshealthcare.com

Our Trusted Data Partners

Precedence Research | Statifacts | Towards Packaging | Towards Automotive | Towards Food and Beverages | Towards Chemical and Materials | Towards Consumer Goods | Towards Dental | Towards EV Solutions | Nova One Advisor | Healthcare Webwire | Packaging Webwire | Automotive Webwire | Nutraceuticals Func Foods | Onco Quant | Sustainability Quant | Specialty Chemicals Analytics

Find us on social platforms: LinkedIn | Twitter | Instagram | Medium | Pinterest

Legal Disclaimer:

EIN Presswire provides this news content "as is" without warranty of any kind. We do not accept any responsibility or liability for the accuracy, content, images, videos, licenses, completeness, legality, or reliability of the information contained in this article. If you have any complaints or copyright issues related to this article, kindly contact the author above.